Adobe: A High-Quality Market Leader at Decade-Low Valuations

Fears of disintermediation from genAI alternatives are overblown as the market underappreciates Adobe’s moat. At decade low valuations, Adobe presents a rare opportunity to buy a high-quality business with potential for revenue acceleration at a discount.

Strategic Analysis: Background and Competitive Advantages

Adobe is the leading global software provider for creative, digital media, and document management solutions. Its flagship products include Photoshop, Illustrator, Premiere Pro, InDesign, and Acrobat, all bundled in the Adobe Creative Cloud subscription suite, which is widely used by creative professionals, enterprises, and educators. Adobe also offers digital experience and marketing software through its Experience Cloud, serving large organizations with tools for data-driven marketing, personalization, and content management. Adobe has established strong brand recognition and dominant market share by providing the industry-leading software for creative design professionals. These moats have allowed Adobe to capture >80% of the creative software market while earning returns on invested capital above 40%. About 95% of Adobe’s revenue consists of recurring SaaS subscription fees.

Adobe’s profitability is supported by substantial barriers to entry based on 1) customer captivity and 2) economies of scale. Customer captivity results from the fact that Adobe products are the industry standard for creative professionals, with a broad ecosystem of integrated software capabilities & platforms that require steep learning curves (high switching costs). Interviews with professional Adobe users confirm that high switching costs lead to a significant customer lock-in effect. The second competitive advantage is derived from Adobe’s economies of scale. With nearly 37 million subscribers, Adobe enjoys the largest customer base in the industry, allowing it to distribute R&D budgets across a larger installed base which in turn leads to more profitable unit economics and margins.

Investment Thesis

1. Overly Bearish Sentiment on Fears of GenAI Competition

On a 12-month forward P/E basis, Adobe’s multiple has compressed to its lowest level since 2012, before the firm’s transition to a SaaS business model. At 17.9x, Adobe trades more than one standard deviation below its 10-year average multiple of 30.7x, while also selling at a significant discount to industry peers on a fwd. P/E (18.8x vs. 27.8x) and PEG basis (1.6 vs. 2.1).

The market is overly pessimistic regarding its expectations of increased competition from GenAI models. As discussed below, the fear of GenAI models generating images and designs that might make Adobe products obsolete is misplaced because it misunderstands the core value proposition of Adobe’s products. Users do not pay for Adobe simply to create images. The value-add is captured after the image has been created as this is when design professionals and marketers can leverage their expertise across the entire value-chain of the creative process from generating and reviewing wireframes (Photoshop, Illustrator, Lightroom) to final deployment (Adobe Experience) and engagement analytics (Adobe Analytics). GenAI will simply be one of several complementary capabilities in Adobe’s ecosystem, enhancing the productivity of creative professionals.

2. Growth Reacceleration

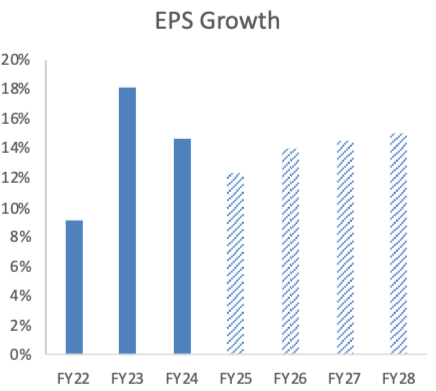

Growth has been stable in the LDD% range in the post-COVID years but the market has failed to recognize the potential for reacceleration in revenue and earnings growth from Adobe’s on-going build-out of 1) its AI-related product offerings and 2) its expanding footprint in the lower-end consumer market through Adobe Express. Adobe’s Firefly and AI credit pack model grew from $5 million to $74 million annualized recurring revenue (ARR) last year, and are well on track to grow to over $250m in 2025. Assuming that 15% to 20% of current Creative Cloud subscribers also sign up for the entry-level Firefly product, Adobe’s genAI revenue could reach $1.5bn to $2bn by FY28. In the medium-term, Adobe is also expected to see a similar revenue boost from its Express product, which has helped expand Adobe’s presence in the lower-end consumer segment and fend off advances from its main competitor in the retail segment, Canva. Combining these two catalysts (Firefly & Express) generates an additional 4 to 5% of above-consensus EPS growth.

Valuation Analysis

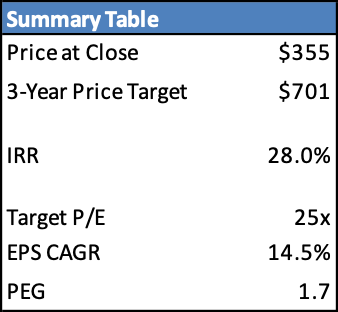

Using a 3-year forecasting horizon, my base case estimates a price target of $701, applying a P/E multiple of 25x. This yields an IRR of 28%, driven by mid-teens EPS CAGR and multiple expansion from currently depressed valuations. The base case assumes that EPS benefits from a continued rollout of Adobe Express and Firefly, in line with management’s expectations. The P/E multiple of 25x is conservatively estimated based on Adobe’s historical multiple of 32x and the relevant peer group median multiple of 28x.

My bull case results in an IRR of 35% on faster Express & Firefly growth and larger multiple expansion, while my bear case results in a -5% IRR due a -7% revenue CAGR and further multiple compression. This yields an attractive return asymmetry for Adobe.

Risks

Key risks to my thesis include:

1. GenAI competition: As mentioned above, the market has compressed Adobe’s multiple on fears that GenAI competition will win key business segments from Adobe. However, the market has already priced in much of these fears despite any substantial evidence in the hard and soft data that Adobe is losing share to GenAI alternatives. Adobe also offers the only AI image generator that complies with copyright laws, while other GenAI engines are facing lawsuits from content providers. With much of the AI fear priced in, buying Adobe at its current price provides a generous margin of safety that compensates investors for bearing this risk.

2. Increased competition from Canva: The lower-end customer segment makes up for about 20% of Adobe’s revenue. If Canva (and other free providers) were to successfully take market share from Adobe this would weigh on revenue growth and lead to returns between my base and bear case. However, customer surveys have not indicated material substitution from Adobe to Canva. At worst, users suggest that Canva and Adobe Express are roughly equivalent, implying that Adobe would, in the worst case, lose some premium pricing power and share (not forfeit) the lower-end segment. This would lower base case results by approximately -1 to -2% annually.

Conclusion

Adobe’s entrenched competitive moats position the company to withstand genAI disruption and unlock new growth catalysts to deliver above-consensus shareholder returns. With multiples already compressed, the current entry point offers a compelling risk-reward profile for patient investors.

This article is neither financial advice nor a recommendation to buy or sell securities. All content is for educational and informational purposes only. Past performance is not indicative of future performance and should not be relied upon to make investment decisions. The author may hold positions in the securities mentioned.