How We Helped a Client Improve Their Dividend Yield and Built a Better Portfolio

A common misconception in investing is that a high-fee, actively managed portfolio is the only way to achieve superior returns. Many investors are surprised to learn that a seemingly modest annual fee can erode a significant portion of their investment gains, especially for income-focused portfolios.

We recently had a client who came to us with this exact situation. They were invested in an actively managed dividend portfolio, and while it was generating income, they felt there had to be a better way to maximize their returns. With our help, they were able to more than double their after-tax dividend yield.

The Problem with Their Actively Managed Portfolio

Our client's existing actively managed portfolio had an estimated gross annual dividend yield of 3.1%. Although this may be a decent dividend yield, we believe a higher yield could be achieved for this client. As we dug deeper, we also uncovered two further issues: high management fees and the impact of taxes.

The portfolio was charging an annual management fee of 0.96%. This fee, while seemingly small, directly reduced the client's income. After fees, their dividend yield dropped to just 2.17%. To make matters worse, our client has a unique tax situation in Europe where all dividends, coupons, and capital gains are taxed at a flat rate of 25%. After accounting for this tax, the client was left with a net dividend yield of just 1.63%.

In short, a significant portion of their returns was being siphoned off by fees and taxes, leaving them with an anemic dividend income to supplement their retirement income.

Crafting a Better Solution

Our stock research team created two alternative portfolios designed to significantly outperform the client's existing account. The goal was simple: create portfolios with a higher dividend yield and lower fees, allowing more of the returns to flow directly to the client.

We created a global dividend portfolio and a Europe-focused dividend portfolio in case the Europe-based client preferred to keep their exposure to European companies. Here are the key features of these two new portfolios:

Zero Management Fees: Both alternative portfolios were designed to be self-managed with annual or semi-annual rebalancing, incurring no management fees, keeping more money in the client's pocket.

Diversification and Growth: To ensure long-term growth and stability, we included a small allocation to low-dividend, high-growth companies. This hybrid approach aims to provide a solid income stream while also benefiting from future capital appreciation.

Comparing the Results

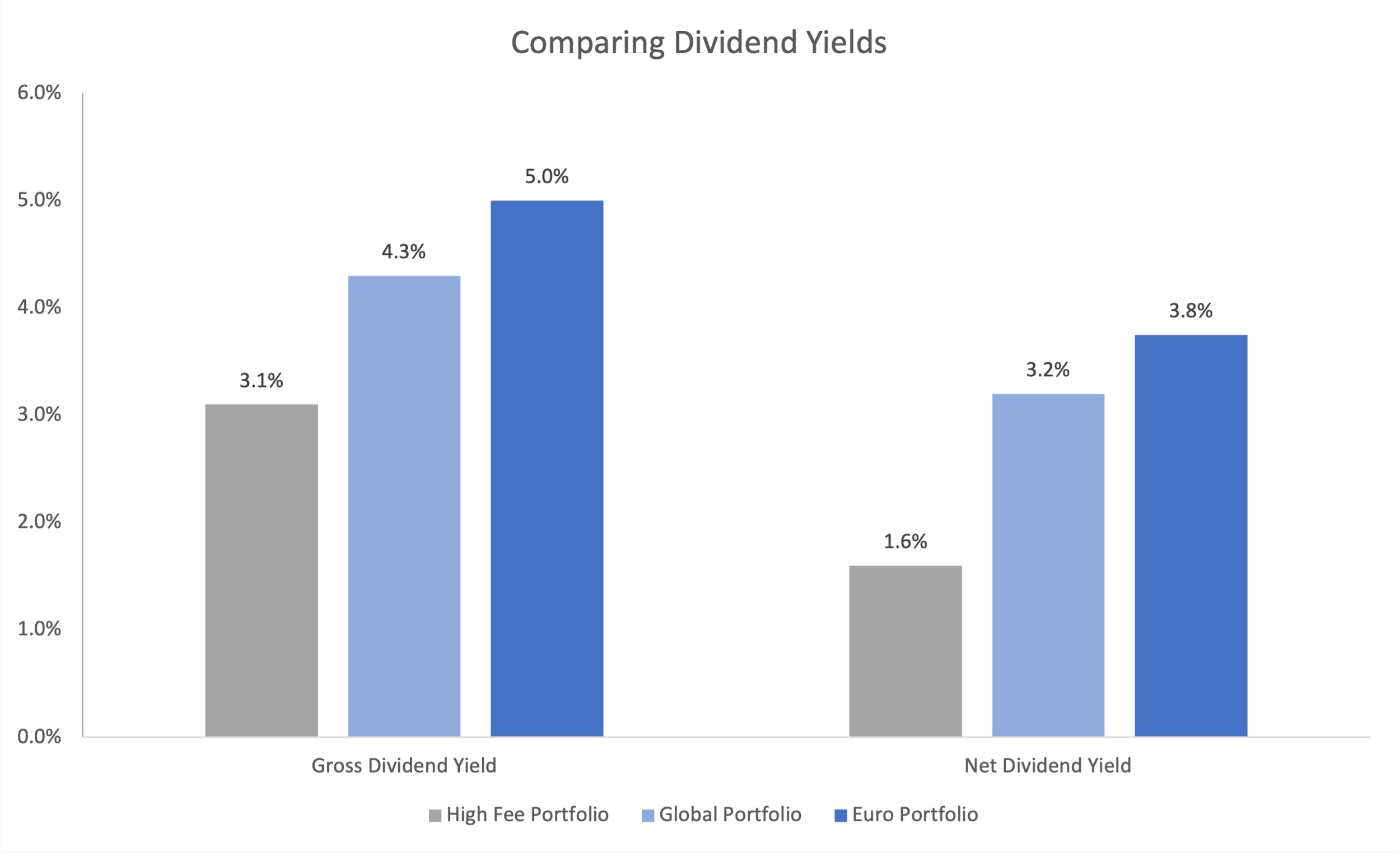

The results were remarkable. We created a visual comparison of the gross dividend yields and the net yields after fees and taxes for all three portfolios.

As you can see in the chart below, both our proposed portfolios offered a significantly higher gross dividend yield than the client's actively managed portfolio.

The Global Dividend Portfolio had a gross yield of 4.30%, and the European Dividend Portfolio had an even higher gross yield of 5.00%.

The real magic happens when we look at the net returns. Since our alternative portfolios have no management fees, the only deduction is the 25% tax. The chart below clearly shows the powerful impact of eliminating fees.

The net yield on the client's actively managed portfolio was only 1.63%, which is completely eclipsed by the net yields of the new portfolios. The Global Portfolio provided a net yield of 3.22%, while the European Portfolio delivered an impressive net yield of 3.75%.

The client's annual dividend income more than doubled just by making this strategic switch. These new portfolios not only beat their existing actively managed account but also any passive ETF alternative in terms of fees.

Portfolio Allocation

To provide a clear picture of the new portfolios, here are the detailed allocations for both the Global and European portfolios.

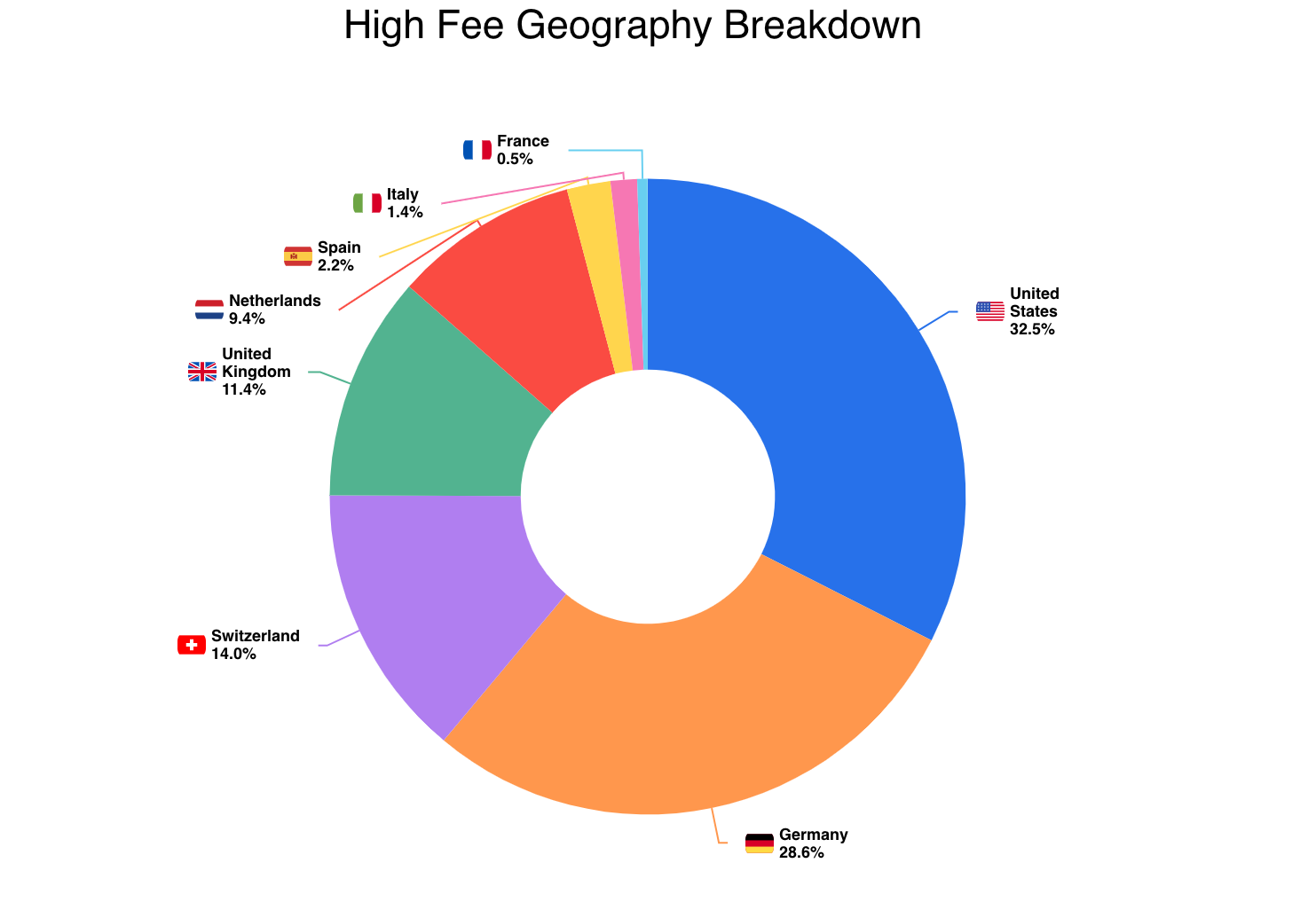

Global Dividend Portfolio

The Global portfolio is diversified across various industries and continents, with a core focus on large, stable companies that pay reliable dividends. No industry holds more than 15% of total fund assets. Although this portfolio allocates 35% to US companies, this is significantly less than the 60 to 70% typically seen in most other global, market-cap weighted portfolios and ETFs.

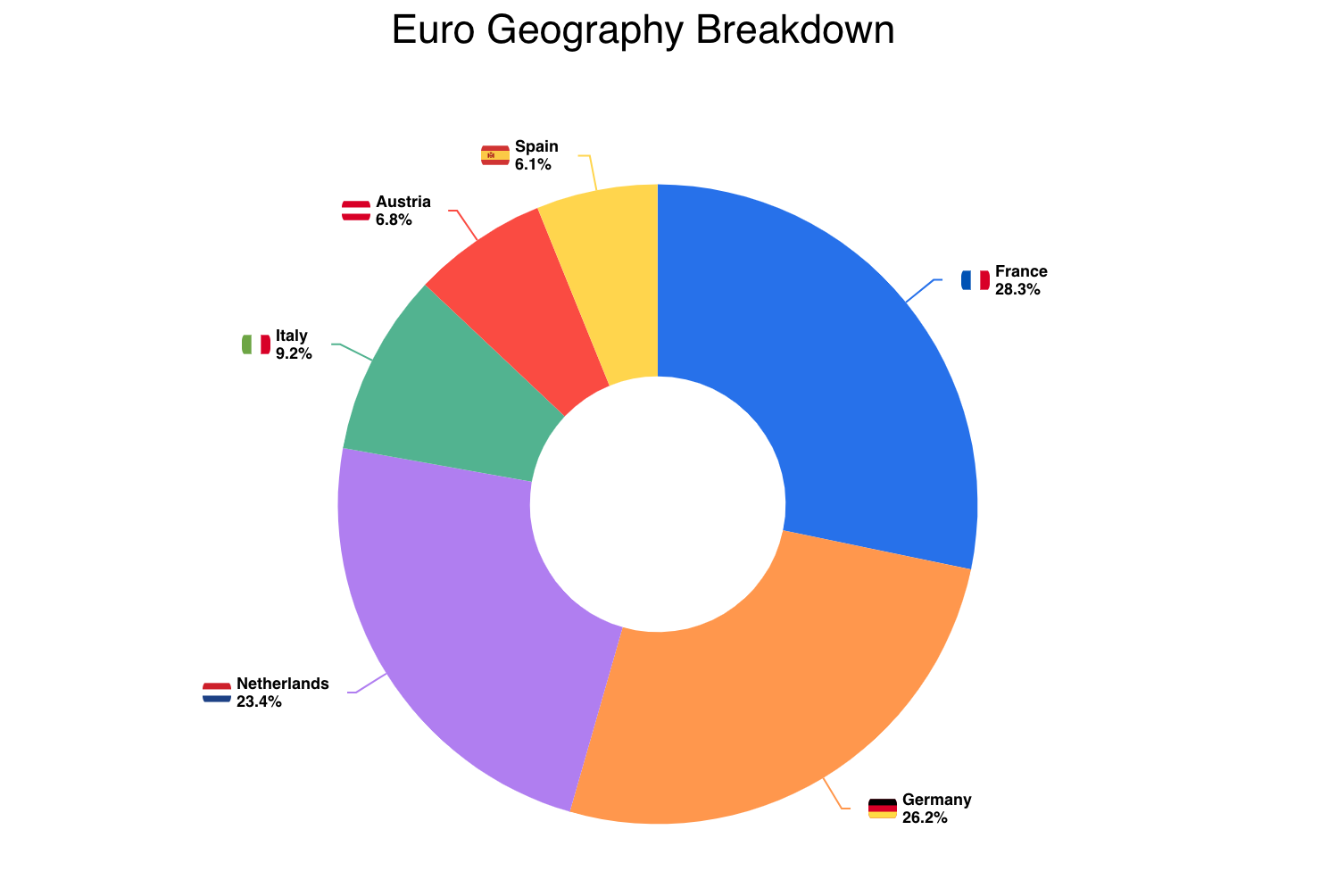

Euro Dividend Portfolio

For the Euro-focused portfolio, we also concentrated on high-quality companies with robust dividend policies. The largest country exposures include Germany, France, and the Netherlands, and higher weights assigned to banks and insurance companies.

The decision to move away from the actively managed account was an easy one for our client. By switching to a high-yield, zero-fee portfolio, they were able to dramatically increase their annual income and gain complete control over their investments.

This article is neither financial advice nor a recommendation to buy or sell securities. All content is for educational and informational purposes only. Past performance is not indicative of future performance and should not be relied upon to make investment decisions. The author may hold positions in the securities mentioned.